Application for ATB Listing

Pathway towards ATB listing

ATB welcomes ambitious companies worldwide to certify their governance standing and open new trading opportunities in Europe. ATB listing process is managed by affiliated advisors and project coordinators.

Apply for Listing

1

Initial Inquiry

Initial inquiry by ATB, designated advisor or project coordinator for suitability assessment

2

Application

Listing application submitted by a company, preparatory work, information collection, capacity building3

ATB Review

Review, verification, and approval by ATB, onboarding, pathfinder for strategic development and support by ATB

4

Listing

Initial listing: ceremony, promotional campaign, followed by continuing presentation, disclosure, trading activities

Requirements

Focus on Integrity

ATB issues recommendations on minimum requirements criteria, but each listing case is assessed individually and may override the minimum eligibility criteria in the sole discretion of ATB Board. In forming its judgment on the listing, ATB assesses each case individually the basis on merits and the quality of the business case, viability of the business, financial standing, reputation and capabilities of management, strategic development achievement and goals, match and suitability of a company with ATB network, capacity of the business to utilize ATB listing for productive and positive outcomes, as well as any other considerations that ATB may deem important to evaluating the listing case.

General Requirements

Soft Requirements

▪ Visible strategy and business development pathway

▪ Corporate commitment

▪ Managerial capacity

▪ Capacity for active promotion, communication and English information production

Case Studies

Suitable Cases for ATB Value-Creating Functions

Growing international company seeks strategic expansion goals in Europe. The company has strong fundamentals and visible business case with motivated and capable management.

Governance listing effect

– Recognition and trust facilitating organic

revenue generation in Europe

– New trade partners and sales channels, competitive advantage over similar companies competing in the same segment

– Track-record building for prospective capital formation, including credit and equity capital markets pathway

– Brand and market visibility, media coverage

Growing international company seeks strategic expansion goals in Europe. The company has strong fundamentals and visible business case with motivated and capable management.

Governance listing effect

– Recognition and trust facilitating organic

revenue generation in Europe

– New trade partners and sales channels, competitive advantage over similar companies competing in the same segment

– Track-record building for prospective capital formation, including credit and equity capital markets pathway

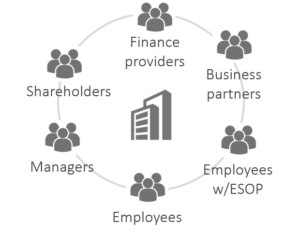

– Brand and market visibility, media coverage Widely-held private company with a number of minority shareholders seeks independent oversight on governance management to secure shareholder protection and value preservation, value-creating operations, good and fair management practices. The company prefers to remain private for strategic and competitive reasons and to avoid overbearing regulatory burden.

Listing effect

– Shareholder and stakeholder interests transparently managed under independent review

– Alignment of interests for all stakeholders under best-practices guidelines

– Visible valuation tools for value creation and distribution, incentives and corporate actions

– Corporate currency

Widely-held private company with a number of minority shareholders seeks independent oversight on governance management to secure shareholder protection and value preservation, value-creating operations, good and fair management practices. The company prefers to remain private for strategic and competitive reasons and to avoid overbearing regulatory burden.

Listing effect

– Shareholder and stakeholder interests transparently managed under independent review

– Alignment of interests for all stakeholders under best-practices guidelines

– Visible valuation tools for value creation and distribution, incentives and corporate actions

– Corporate currency Company with equity investments from institutional VC/PE fund(s) seeks efficient portfolio company management and coordination. The asset managers and their investors need to coordinate jointly on 1) management and company oversight, 2) valuation reference, 3) financial transactions related to funding/syndication/exits. Listing may be arranged transparently private only to designated stakeholders if needed for strategic purposes.

Governance listing effect

– Efficient company and management oversight and standardized reporting mechanism to the investors and asset managers

– Valuation reference benchmark

– Efficiency in disclosure, coordination, and standardized governance for financial transactions eliminating redundancies in transaction executions

“PILE” transaction (private investment in listed entity), similar to PIPE for related benefits

– Support for exits and secondary transactions

Company with equity investments from institutional VC/PE fund(s) seeks efficient portfolio company management and coordination. The asset managers and their investors need to coordinate jointly on 1) management and company oversight, 2) valuation reference, 3) financial transactions related to funding/syndication/exits. Listing may be arranged transparently private only to designated stakeholders if needed for strategic purposes.

Governance listing effect

– Efficient company and management oversight and standardized reporting mechanism to the investors and asset managers

– Valuation reference benchmark

– Efficiency in disclosure, coordination, and standardized governance for financial transactions eliminating redundancies in transaction executions

“PILE” transaction (private investment in listed entity), similar to PIPE for related benefits

– Support for exits and secondary transactions Successful entrepreneurial company wishes to establish reputational recognition, publicity, promotion, networks, and new growth options

Governance listing effect

– Reputational recognition and credibility

– Certification on corporate integrity and good governance standing

– Publicity, promotion, networks

– New growth options and corporate development in Europe

Successful entrepreneurial company wishes to establish reputational recognition, publicity, promotion, networks, and new growth options

Governance listing effect

– Reputational recognition and credibility

– Certification on corporate integrity and good governance standing

– Publicity, promotion, networks

– New growth options and corporate development in Europe Investment fund, e.g. real-estate investment trust (REIT), or asset-backed SPV targets asset acquisition or management in the EU, seeks governance mechanism, disclosure, valuation reference, reporting, and market access.

Governance listing effect

– Efficient governance and shareholder management

– Deal and asset sourcing pipelines, networks

– Support for exits and secondary transactions

Investment fund, e.g. real-estate investment trust (REIT), or asset-backed SPV targets asset acquisition or management in the EU, seeks governance mechanism, disclosure, valuation reference, reporting, and market access.

Governance listing effect

– Efficient governance and shareholder management

– Deal and asset sourcing pipelines, networks

– Support for exits and secondary transactions